Economic Update

Just as many economic commentators said in the news, recent political and budgetary changes and U-turns are like nothing we have experienced before. What is very clear is that this is a very real crisis for many households. The government action on energy costs was welcomed by many of those in need, but the savings on this are dwarfed by potential rises in mortgage rates. Galloping inflation, the highest we have seen in over 40 years, saw food and household prices also rise at nearly 10% just in the recent months.

This is not a UK limited crisis and is affecting the majority of the countries globally, however with the lack of political stability and a clear economic strategy our challenges are more profound and harder to navigate.

In the last few weeks we have been through a lot, in terms of economic, political and global changes.

Just as many economic commentators said in the news, recent political and budgetary changes and U-turns are like nothing we have experienced before. What is very clear is that this is a very real crisis for many households. The government action on energy costs was welcomed by many of those in need, but the savings on this are dwarfed by potential rises in mortgage rates. Galloping inflation, the highest we have seen in over 40 years, saw food and household prices also rise at nearly 10% just in the recent months.

This is not a UK limited crisis and is affecting the majority of the countries globally, however with the lack of political stability and a clear economic strategy our challenges are more profound and harder to navigate.

In the last few weeks we have been through a lot, in terms of economic, political and global changes.

We’ve also come through several difficult challenges over the past few years, and it is draining. Whether Brexit (and the divisions it causes), or COVID-19, or climate change, War in Ukraine, or energy prices, waking up every day to uncertainty and stress is NOT good for any of us. The last week has felt even more distressing since the people in charge – the government who we usually look to for reassurance – are the ones who’ve helped create the mess.

In the three months to 30 September 2022, the UK’s FT All-Share index declined by just over 6%. This was driven by global growth or rather recession concerns (with over 70% of the all-important FTSE 100 earnings derived from overseas markets), fuel bill worries, and fears over what might follow on from the appointment of a new Prime Minister.

The period in question was also marked by a sharp decline in the value of the Pound, with further falls seen immediately after the new Chancellor’s ‘mini-budget’ in the final week of September. Currency moves of this nature will often result in investor enthusiasm for companies with large overseas earnings, and a rotation out of more domestically orientated stocks. This was somehow reversed following the appointment of the new Chancellor Jeremy Hunt and his dramatic U-turn on the majority of his predecessor’s mini-budget announcements.

Looking ahead

From a social point of view, we should remember that normal life will continue. Schools will still open, hospitals will function, and trains will still run (but after today’s news – I am not so sure about that). We might spend a lot of time talking about politics over the next couple of weeks – but it will be in our usual pubs and bars, or restaurants, or with friends. And at some point, the economy will pull through. It always does.

We often talk about the benefits of diversification in our portfolios, spreading risk across assets, sectors and countries. Most of the time, it doesn’t get too much thought; risk management is rarely exciting. But at times like this it becomes incredibly powerful. We believe that our active, global and diversified approach to investment means that Haverfords clients are as well positioned as possible.

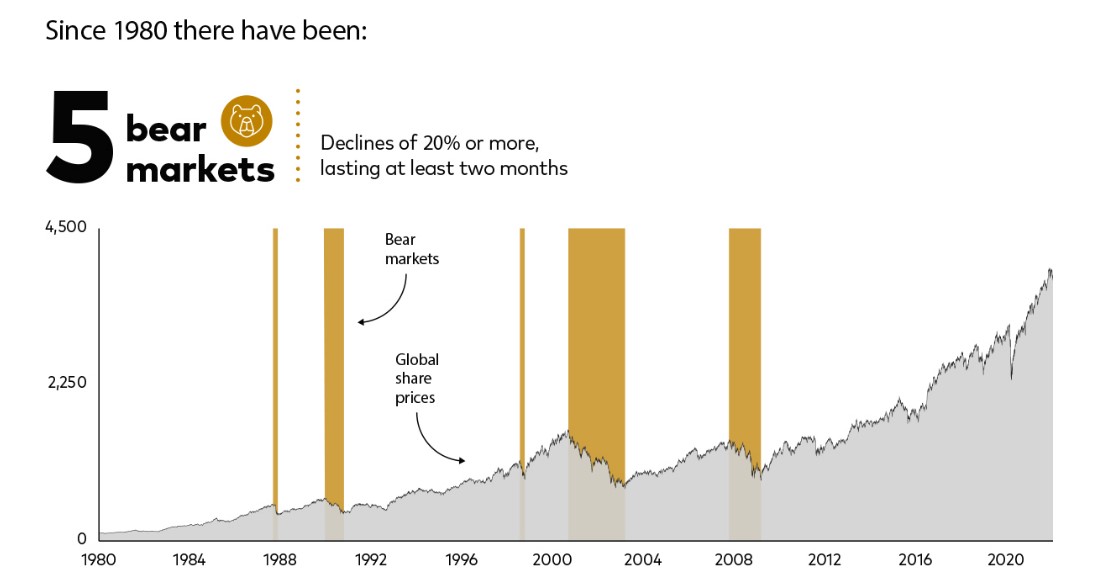

One of the most important things I keep mentioning when in meetings with clients, is that when investing you don't lose any money unless you sell. Even if stock prices drop, you haven't technically lost anything as long as you continue to hold your investments. Eventually, the market will recover. The stock market has experienced dozens of crashes and corrections over the decades and it's bounced back 100% of the time to recover and grow further (see chart at the bottom of the page).

By holding your investments, you can simply ride out the storm and wait for prices to rebound.

In terms of the wider economy: "Looking ahead, we continue to expect the headline rate of CPI inflation to rise to nearly 11% in October, primarily due to the 27% increase in consumer energy prices. But the headline rate should fall back to about 9% at the beginning of 2023, as the anniversary of big increases in food and motor fuel prices is reached," says Samuel Tombs, chief UK economist at Pantheon Macroeconomics.

Core goods CPI inflation also should decline, given that commodity prices and shipping costs have fallen, and both manufacturers and retailers now report that they have far too much stock in relation to demand. And while services inflation will be boosted by faster increases in rents, the combination of weakening consumer demand and emerging slack in the labour market should slow price rises for many discretionary services.

In the three months to 30 September 2022, the UK’s FT All-Share index declined by just over 6%. This was driven by global growth or rather recession concerns (with over 70% of the all-important FTSE 100 earnings derived from overseas markets), fuel bill worries, and fears over what might follow on from the appointment of a new Prime Minister.

The period in question was also marked by a sharp decline in the value of the Pound, with further falls seen immediately after the new Chancellor’s ‘mini-budget’ in the final week of September. Currency moves of this nature will often result in investor enthusiasm for companies with large overseas earnings, and a rotation out of more domestically orientated stocks. This was somehow reversed following the appointment of the new Chancellor Jeremy Hunt and his dramatic U-turn on the majority of his predecessor’s mini-budget announcements.

Looking ahead

From a social point of view, we should remember that normal life will continue. Schools will still open, hospitals will function, and trains will still run (but after today’s news – I am not so sure about that). We might spend a lot of time talking about politics over the next couple of weeks – but it will be in our usual pubs and bars, or restaurants, or with friends. And at some point, the economy will pull through. It always does.

We often talk about the benefits of diversification in our portfolios, spreading risk across assets, sectors and countries. Most of the time, it doesn’t get too much thought; risk management is rarely exciting. But at times like this it becomes incredibly powerful. We believe that our active, global and diversified approach to investment means that Haverfords clients are as well positioned as possible.

One of the most important things I keep mentioning when in meetings with clients, is that when investing you don't lose any money unless you sell. Even if stock prices drop, you haven't technically lost anything as long as you continue to hold your investments. Eventually, the market will recover. The stock market has experienced dozens of crashes and corrections over the decades and it's bounced back 100% of the time to recover and grow further (see chart at the bottom of the page).

By holding your investments, you can simply ride out the storm and wait for prices to rebound.

In terms of the wider economy: "Looking ahead, we continue to expect the headline rate of CPI inflation to rise to nearly 11% in October, primarily due to the 27% increase in consumer energy prices. But the headline rate should fall back to about 9% at the beginning of 2023, as the anniversary of big increases in food and motor fuel prices is reached," says Samuel Tombs, chief UK economist at Pantheon Macroeconomics.

Core goods CPI inflation also should decline, given that commodity prices and shipping costs have fallen, and both manufacturers and retailers now report that they have far too much stock in relation to demand. And while services inflation will be boosted by faster increases in rents, the combination of weakening consumer demand and emerging slack in the labour market should slow price rises for many discretionary services.

Source: Vanguard analysis based on the MSCI World Index from 1st January 1980 to 31 December 1987, and the MSCI AC World Index thereafter. Both indices are denominated in GBP

The chart, which stretches back more than 40 years and contrasts the number of global downturns seen over this period, including so-called ‘bear markets’, with the brighter longer-term performance of global stock markets.

Market downturns barely register when taking a long-term perspective.

Please contact me if you have any questions regarding your pensions or investments.

Mark Chiva

Director, Independent Financial Adviser

The chart, which stretches back more than 40 years and contrasts the number of global downturns seen over this period, including so-called ‘bear markets’, with the brighter longer-term performance of global stock markets.

Market downturns barely register when taking a long-term perspective.

Please contact me if you have any questions regarding your pensions or investments.

Mark Chiva

Director, Independent Financial Adviser